Consumer spending accounts for about two-thirds of U.S. gross domestic product (GDP), so it plays an outsized role in driving economic growth or slowing it down.1 For the last 18 months, U.S. consumers have kept the economy strong despite high inflation and rising interest rates. The question now is whether consumers can maintain this momentum through the holiday season and into 2024.

In considering this, it’s important to keep in mind that the Federal Reserve is trying to cool spending through higher interest rates, in their effort to combat inflation. So a moderate slowdown in spending is not necessarily bad for the economy. But throwing it into full reverse could lead to a recession, making it a delicate balance.

Measuring spending and inflation

The standard measure of consumer spending is personal consumption expenditures (PCE), released each month by the Bureau of Economic Analysis (BEA). Economists look at the monthly change in PCE for the short-term trend and the year-over-year change for the longer-term trend.

In the most recent report, September PCE increased 0.7% over August, a strong monthly growth rate and up from 0.4% in August over July. The September increase was 0.4% measured in “real” inflation-adjusted dollars, which indicates that consumers were spending higher than the rate of inflation. The annual change in PCE was 5.9%, well above the 3.4% annual change in the PCE price index, which is the Fed’s preferred measure of inflation. (The Fed’s target for PCE inflation is 2%.)2–3

The pandemic effect

The current consumer spending story began with the pandemic recession, when a broad range of business activity stopped, and consumers received large government stimulus packages with little to spend it on. In April 2020, the personal saving rate — the percentage of personal income that remains after taxes and spending — spiked to a record 32%, almost double the previous high. It declined as businesses reopened but remained above pre-pandemic levels until late 2021, when stimulus had ended and high inflation made spending more expensive. The saving rate in September 2023 was just 3.4%, well below the 6.5% average before the pandemic.4 While a low saving rate could be cause for concern in the long term, it indicates that consumers are willing to spend their income despite higher prices.

Why are consumers spending instead of saving?

Multiple explanations have been offered for this high-spending/low-saving pattern. Some lower-income consumers may be spending a larger percentage of their income because they have to — they are spending more for basic needs due to high inflation. People with more disposable income might still be responding to pent-up demand for goods and services that were not available during the pandemic. And, after the tragedies and disruptions of the pandemic, some consumers may prefer to spend now and worry less about the future. The expensive housing market could be adding to this trend by making a typical saving goal seem unattainable to younger consumers.5

On a macro level, however, consumers may be spending instead of saving because they still have substantial savings. Although it was thought that pandemic-era savings were nearly exhausted, revised government data suggests there may be $1 trillion to $1.8 trillion in so-called “excess savings” still available. About half of this is likely held by households in the top 10% income bracket, but that still leaves a large savings buffer that could continue to drive middle-class spending for some time.6

The recently released Federal Reserve Survey of Consumer Finances revealed a similar story. The average inflation-adjusted median net worth of American families jumped by a record 37% from 2019 to 2022 — more than double the previous highest increase in the Fed survey, which is released every three years. Every demographic group saw substantial increases, but the largest by far was for consumers under age 35, whose net worth increased 143%. Because this survey only went through 2022, it does not capture the effects of continuing inflation in 2023.7

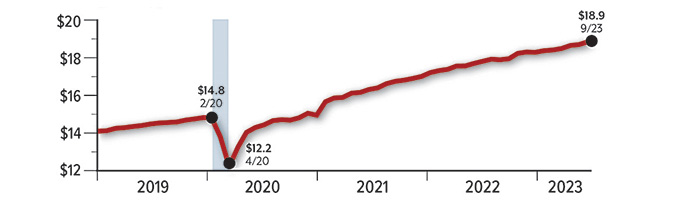

Strong Spending

Consumer spending, in trillions (shaded area indicates recession)

Source: U.S. Bureau of Economic Analysis, 2023 (monthly personal consumption expenditures, seasonally adjusted at annual rate)

Wages and inflation

While pandemic-era savings may support consumer spending well into 2024, only wages can maintain strong spending for the long term. The question is whether wages will keep up with inflation without rising so quickly that they drive inflation even higher. For the 12-month period ending September 2023, average hourly earnings increased 4.2%. This was above the 3.4% PCE inflation rate over the same period, but down from the 5.1% pace of wage increases a year earlier.8 The fact that wage growth is keeping up with inflation while also slowing down bodes well for the goal of taming inflation with continued consumer spending.

Holiday spending

The winter holiday season, officially defined as November and December, accounts for about 20% of retail spending for the year, and is even more important for some retailers. An annual survey by the National Retail Federation found that consumers plan to spend an average of $875 this year on gifts, decorations, holiday meals, and other seasonal items. This is up from $833 in 2022 and slightly above the five-year average.9 Two broader surveys have found declines in consumer confidence in recent months, but it remains to be seen whether this leads to a decline in spending.10–11 While the winter holidays are not a “make or break” situation for the U.S. economy, this year’s holiday spending may provide clues to consumer behavior in the new year.

Can Consumers Keep Carrying the Economy?

Can Consumers Keep Carrying the Economy?